As Kenya steps into the second half of the 2020s, the government faces the daunting task of navigating a turbulent economic landscape marked by high public debt, rising living costs, and simmering political discontent. The draft Finance Bill 2025, approved by Cabinet in April but yet to be tabled in Parliament, is the first full attempt by the Kenya Kwanza administration to reset fiscal policy after the seismic upheaval of 2024. While the new proposals stop short of introducing fresh taxes, the macroeconomic and political pressures that shape this bill reveal deeper tensions within the country’s economic direction.

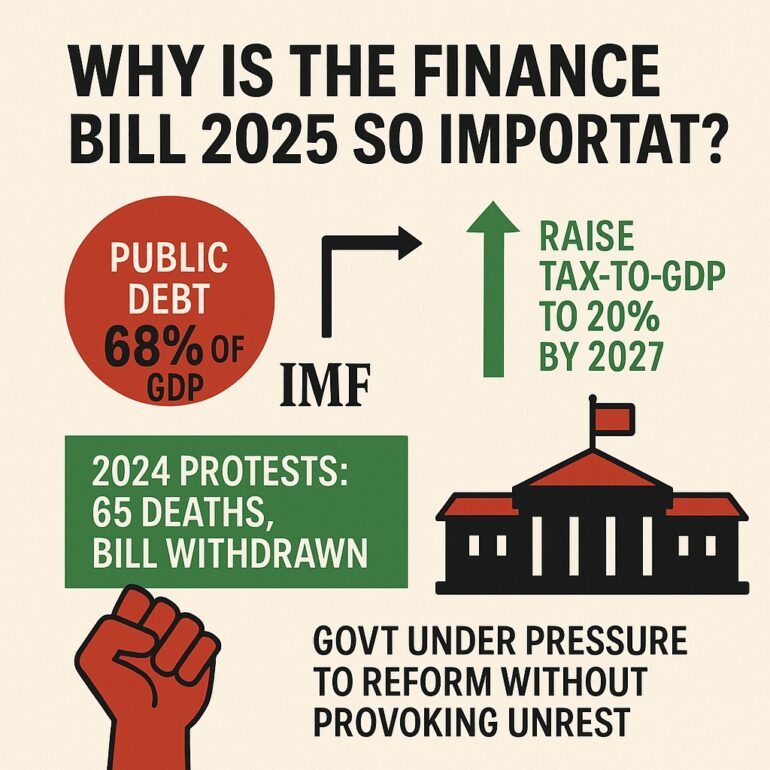

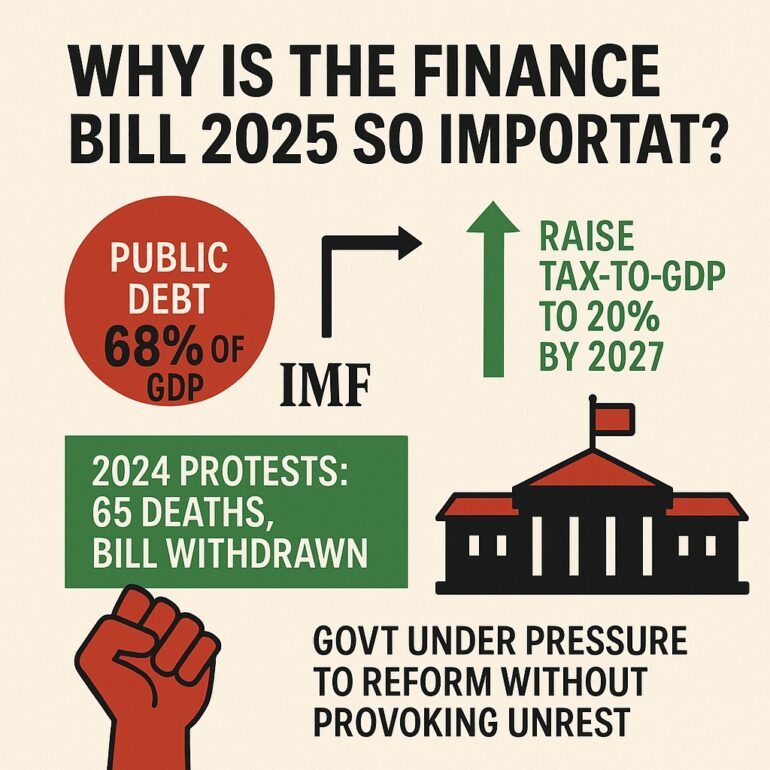

The 2024 Finance Bill had ignited a wave of mass protests not seen in Kenya in decades. Branded as a “people’s tax revolt,” the #RejectFinanceBill2024 movement mobilized thousands of young Kenyans, primarily through social media, and culminated in the unprecedented breaching of Parliament grounds. The demonstrations, which led to at least 65 deaths and hundreds of arrests, were sparked by the government’s aggressive push to raise KES 346 billion through new taxes—ostensibly to service debt and fund development. These events forced President William Ruto to withdraw the bill on June 28, 2024, in what many viewed as a rare instance of public pressure forcing a policy U-turn.

The unrest laid bare a nation buckling under the weight of austerity, with a public debt-to-GDP ratio hovering at 68%, far above the IMF and World Bank’s 55% recommended threshold. Kenya’s commitments under a US$3.6 billion Extended Credit Facility and Extended Fund Facility with the International Monetary Fund require reforms aimed at raising the tax-to-GDP ratio to 20% by 2027. These targets have become the central tension between the state’s obligations to global lenders and its duty to maintain domestic social stability.

What Are the Changes in the Finance Bill 2025?

It is against this backdrop that the Finance Bill 2025 emerges—not with the loud clang of new taxes, but with the quieter hum of technical reforms. Rather than levying fresh burdens, the bill proposes to tighten tax administration, close loopholes, and expand the tax net through indirect measures. This includes increasing the fringe benefit tax, widening the tax-free per diem allowance, and adjusting VAT classifications in ways that may still increase the cost of essential goods. Here’s a breakdown of the key changes

- Fringe Benefit Tax: Tax on Employee Perks Rises from 9% to 30%

Fringe Benefit Tax (FBT) is a tax charged on non-cash benefits employers give to their employees—things like company cars, housing, or subsidized loans. Under the proposed bill, the tax rate on such perks will more than triple from 9% to 30%.

For instance, if an employee receives a car worth KES 100,000 as a benefit, the tax would now be KES 30,000 instead of KES 9,000. This sharp increase may prompt companies to reduce such perks or shift the cost to employees, lowering take-home benefits. “This raises costs for companies offering perks like company cars,” notes economics journalist Julians Amboko, implying that employees may either lose these benefits or shoulder the tax burden indirectly.

- Per Diem Allowance: Tax-Free Threshold Raised from KES 2,000 to KES 10,000

Per diem is the daily allowance paid to employees for work-related travel. Previously, only the first KES 2,000 was exempt from tax; anything above that was taxed. The Finance Bill 2025 proposes increasing this tax-free threshold to KES 10,000. So, if your employer pays you KES 8,000 for travel, the whole amount would now be tax-free—giving relief to traveling employees, particularly in the private sector.

- VAT on Digital Services: 16% VAT on Streaming, E-Learning, and Software Updates

Value Added Tax (VAT) is now set to be imposed on digital services at a rate of 16%. This applies to things like Netflix subscriptions, online courses, and software updates.For example, if you pay KES 1,000 for a streaming subscription like Showmax or Nebula, it will now cost KES 1,160. The aim is to ensure digital service providers contribute to tax revenues like traditional businesses. While this boosts revenue, the cost of education and entertainment could rise. Consumers who embraced digital platforms during the pandemic might feel the pinch.

- VAT Zero-Rating Removed: Items Like Solar Batteries and Animal Feed Now VAT-Exempt

Zero-rated goods are taxed at 0% VAT, and businesses can claim back VAT on their inputs. VAT-exempt goods don’t charge VAT to the buyer, but businesses cannot claim back their input VAT.

The Finance Bill 2025 proposes shifting goods like pharmaceutical inputs, animal feed, solar and lithium-ion batteries, and electric bicycles from zero-rated to VAT-exempt status.As financial activist Uchumi Bora explains: “It’s where the hidden taxes live… By denying businesses VAT refunds, production costs rise—and so do prices for the consumer.”

Amboko also warns of medium-term effects:“This could raise consumer prices in healthcare, agriculture, and renewable energy… discouraging investment in green tech.”

- VAT Refund Timelines: Processing Extended from 90 to 120 Days; Audits from 120 to 180 Days

VAT refund is the money businesses get back for tax paid on inputs. Under the new bill, refund timelines will increase from 90 to 120 days, and audits will take up to 180 days.This means businesses will wait longer for cash that is rightfully theirs, potentially affecting their cash flow. “Longer delays could strain exporters’ working capital,” notes Amboko, as he particularly points out that capital-heavy industries like agriculture and manufacturing would suffer more.

- KRA Data Access: Access to Bank and M-Pesa Details Without Court Order

The bill removes legal restrictions that previously prevented the Kenya Revenue Authority (KRA) from accessing private financial data without a court order.Now, KRA would be allowed to access personal and business bank accounts, and M-Pesa transactions, in its bid to catch tax cheats.This has sparked a backlash over privacy. A popular finance account @moneyacademyke tweeted: “Treasury wants KRA to access private customer data by removing legal protections… If passed, KRA won’t need a court order to get this info.”

- Motor Vehicle Tax: Annual Tax Based on Engine Size and Car Value

The bill introduces a new annual tax on vehicles based on engine capacity and car value. Owners of high-powered, expensive cars will pay more.This tax is designed to boost revenue without introducing blanket hikes, but it could make vehicle ownership more costly for the middle class.

- Eco Levy: Environmental Tax on Imported Electronic Goods

An eco-levy is a fee imposed on imported finished electronic products like phones, TVs, and laptops to address the problem of e-waste.This cost is likely to be passed on to consumers. A phone that previously cost KES 20,000 may now cost several hundred shillings more.While this supports sustainability efforts, it could widen the digital divide by making tech less affordable for lower-income Kenyans.

A Mixed Reception: Relief, Skepticism, and Digital Resistance

The release of the Finance Bill 2025 has drawn a cautious but deeply analytical response from the Kenyan public. Many citizens, especially salaried workers, have expressed relief that their payslips are not being targeted again—at least not directly—to repay debts amassed under previous administrations. For a country still reeling from the 2024 protests and the memory of tear gas, arrests, and fatalities, the absence of sweeping tax hikes has been welcomed as a political cooling-off gesture.

Still, structural criticisms persist. Activists and analysts alike have warned that the bill’s quiet tweaks—such as moving items from zero-rated to VAT-exempt or granting KRA unchecked access to financial data—are simply new bottles for old austerity wine. To many, the government appears to be changing tactics, not direction, in its quest to satisfy IMF benchmarks without igniting another public revolt. President Ruto’s recent diplomatic charm offensive in China, where he secured infrastructure deals based on alternative financing models that do not place immediate debt pressure on the Kenyan taxpayer, has added another layer to the narrative. These agreements signal a strategic shift away from the Eurobond-heavy borrowing that has previously strained national coffers.

At the same time, a new generation of digitally savvy Kenyans is shaping the discourse. Platforms like the “Finance Bill 2025 GPT,” a citizen-built AI tool designed to break down the bill’s clauses into plain language, have emerged as powerful civic tools. Young creators, lawyers, and coders are using Twitter/X threads, TikTok explainers, and podcasts to democratize understanding of complex fiscal policies—transforming public finance from elite jargon into a shared national conversation.